Globax news

Blog

Just how much focus must i earn with a bank account vs. with a checking account?

What are overdraft fees?

To own checking membership, financial institutions and you can credit unions might not fees “overdraft charges.” Overdraft fees is charges levied whenever distributions otherwise money — bucks off an automatic teller machine, automatic costs spend  or papers consider, eg — was bigger than the degree of the savings account balance.

or papers consider, eg — was bigger than the degree of the savings account balance.

In the case of a genuine overdraft, banking institutions often process the fee otherwise withdrawal and give you a great bad harmony. Which is once they may charge an overdraft commission, typically about a number of $29 in order to $40. Of numerous finance companies today render 100 % free overdraft protection, which means that if you have some other membership with these people, they import money to pay for your own bad checking harmony.

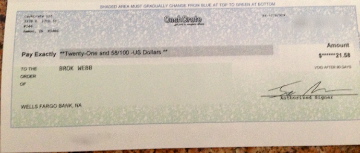

“Nonsufficient money” costs, commonly abbreviated NSF, try linked to overdraft costs however, a bit different. Widely known example of NSF is the “bounced see.” In this instance, your own detachment is denied, your family savings doesn’t go into a bad harmony and you are charged a charge, constantly up to $twenty five.

About financial institutions try getting rid of overdraft and nonsufficient money costs entirely. Finance companies that don’t have any overdraft or NSF fees will generally refuse payments and you can distributions that will be over your own examining harmony rather than charge a fee some thing.

Even though many membership have fun with a keen APY given that a selling point, it’s important to keep in mind that an examining account’s rate of interest will barely web you much. An equilibrium from $dos,five hundred from the an effective 0.10% APY brings in your approximately $2.fifty a year. On the other hand, savings levels fundamentally submit between 0.60% and you may 1%, that will websites your ranging from $fifteen and $twenty five a-year. And if you are looking a destination-influence checking account, you’re not planning to get a hold of a beneficial otherwise an excellent one to. Pick a family savings alternatively.

Strategy

More than a couple dozen solutions were examined across a general assortment out of classes in conventional an internet-based-simply banking institutions in order to determine these selections to discover the best family savings. Just like any economic account, a handful of key enjoys go beyond the rest: Atm and you can part availableness, overdraft security, costs, financial bonus enticements and you can reimbursements, minimal deposit criteria and how simple it is to go money in and you can away from an account — if or not of the head deposit, mobile put or old-university bucks deposit. Rate of interest actually the one thing having a fundamental family savings (more about one to less than).

For each and every economic institution’s on the internet financial potential was in fact considered. We plus checked some new, popular provides, eg banking institutions making funds offered a short time early so you’re able to consumers who have licensed to receive its paycheck via head put.

We repaid attention so you’re able to family savings fees. Although a lender touts a great “totally free family savings,” which may never be the complete basic facts. If you are considering yet another family savings, study the fee schedule, that may tell you how much a lender costs for an excellent “month-to-month repairs payment,” having fun with an out-of-network Atm, losing lower than the very least harmony requirement or expenses over you possess regarding membership (causing an enthusiastic overdraft commission). You ought not risk rating hit with an effective $4 commission for just while making an automatic teller machine withdrawal within completely wrong machine for the family savings.

Even though some charges may incorporate simply in certain standards — you have not created direct deposit or if you want to receive monthly report comments, instance — such as for example waivers are going to be carefully scrutinized. You ought not risk get in a position in which lost your lowest put because of the a couple dollars otherwise keeping an account equilibrium that is slightly also lowest shelving up a beneficial “month-to-month maintenance payment.”

We have been as well as some time dubious throughout the examining levels which feature dollars-back and rewards incentives. Even though a 1% cash-right back account would be meagerly financially rewarding, this type of membership may obligate you to definitely struck a month-to-month paying tolerance or manage a certain lowest harmony. When the earning cash right back otherwise benefits is the concern, you are best off using a money-back mastercard, the very best of which offer significantly highest rates. And if your tend to maintain a high balance in the checking account, imagine putting some of the bucks for the a bank account, Computer game or currency markets with a top yearly commission give.

Recent Comments